Attention Homeowners: Unlock the Power of Falling Rates with a $10,000 HELOC

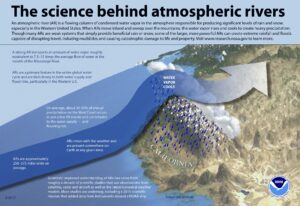

With interest rates on the decline, now is the perfect time to consider a $10,000 Home Equity Line of Credit (HELOC). But how much will it really cost you each month? Read on to unravel the intricacies of HELOCs and discover the potential savings that await you in today’s financial landscape.

- Unraveling the Monthly Costs of a $10,000 HELOC Amidst Declining Rates

Monthly costs for a $10,000 HELOC have significantly declined as interest rates continue to fall. Assuming a conservative interest rate of 5.5%, your monthly payments would be around $62. This includes both principal and interest, and the total cost of interest over the 30-year loan term would be $9,134. Of course, the actual costs will vary depending on the interest rate and loan term you secure. It’s always a good idea to shop around for the best rates and compare offers from multiple lenders to ensure you get the most favorable terms possible.

– Dissecting the Impact of Rate Fluctuations on HELOC Payments

As interest rates fluctuate, it’s essential to understand how these changes affect your Home Equity Line of Credit (HELOC) payments. When rates rise, your monthly payments will increase, potentially putting a strain on your budget. Conversely, if rates fall, as they have recently, you may find yourself with lower monthly payments, providing some financial relief. It’s important to monitor rate changes and adjust your budget accordingly to ensure you’re prepared for potential increases or decreases in your HELOC payments.

– Exploring the Interplay of Principal, Interest, and Time

As interest rates continue to fluctuate, homeowners may wonder: How much would their HELOC payment be with the latest rate changes? For a $10,000 HELOC, your principal is the initial amount borrowed (in this case, $10,000). The interest rate is the percentage you’re charged on the principal, and the time reflects the duration of your loan. By understanding the interplay between these factors, you can strategize your payments and ensure you’re getting the most out of your home equity.

– Maximizing Savings: Strategies for Reducing Monthly Payments

Maximizing Savings: Strategies for Reducing Monthly Payments

- Consolidate debt: Combine multiple high-interest debts, such as credit cards and personal loans, into a single loan with a lower interest rate. This can significantly reduce your monthly payments and save you money on interest.

- Negotiate with creditors: Reach out to your creditors to see if they’re willing to lower your interest rates or waive late fees. If you have a good payment history and a strong credit score, they may be more likely to work with you.

- Reduce your expenses: Take a close look at your monthly budget and identify areas where you can cut back on spending. This could include things like eating out less, switching to a cheaper cell phone plan, or negotiating lower bills.

- Comparing Interest Rates: Finding the Most Competitive Options

Comparing Interest Rates: Finding the Most Competitive Options

With interest rates fluctuating, it’s crucial to compare offers from multiple lenders to secure the most competitive rates for your HELOC. Use online comparison tools that allow you to enter your loan amount and credit information to generate a list of available options. These tools typically display interest rates, fees, and loan terms side by side, making it easy to identify the most favorable choices. Don’t hesitate to reach out to different lenders directly for personalized quotes, as they may offer exclusive promotions or adjustable rate options that are not available through online platforms.

– Expert Advice: Navigating the Repayment Landscape of a HELOC

Understanding Your Monthly Repayment

The formula for calculating your HELOC payment depends on the current adjustable rate index (ARI) and margin. Assuming the current ARI is 2.99% and your margin is 2.50%, your interest rate would be 5.49% (2.99% + 2.50%). On a $10,000 HELOC with a 10-year term, your estimated monthly payment would be around $112. This amount includes both principal and interest, and it may fluctuate slightly as interest rates change. It’s important to keep in mind that the minimum monthly payment for a HELOC is typically only interest, which could extend the repayment period and increase the total cost of the loan.

Insights and Conclusions

As interest rates find their footing, your monthly HELOC payments may experience a shift. Keep an eye on market trends and consult your lender for personalized advice. By staying informed, you can navigate the evolving landscape and make informed decisions about your financial future.